A manufacturer may have opportunities to grow its business by winning more contracts or getting funding, and it can use its solid business credit profile to help accomplish that.If a manufacturer’s business credit report isn’t up to date, they may not get the best terms or conditions (this can be true of bank loans as well). They will want to get good terms when signing contracts with other businesses.Their business credit profile may help convey a manufacturer’s capabilities to a potential partner. They make goods for other companies and will be counted on by those companies to deliver what they have promised.Manufacturers may benefit from their business credit file because: Since manufacturers work with other businesses, it can be important for them to convey their credibility to partners and potential partners. Here’s how getting a D‑U‑N‑S Number can benefit manufacturers, suppliers, and construction business owners, specifically: The D‑U‑N‑S Number for Manufacturers Learn more about the difference between a D‑U‑N‑S Number and a Tax ID Number Getting a D-U-N-S Number is the first step in joining the Dun & Bradstreet Data Cloud and potentially building your business credit file, and you may leverage your business credit file to help your company get loans, contracts, and more. Unfortunately, many business owners don’t pay attention to their business credit scores and ratings, and their business credit file may not reflect their credibility when their partners and prospects look at it. If you’re using the D-U-N-S Number to monitor your business relationships, you can understand that the companies you work with or want to work with might also be using yours to help assess your company. Requires less exhaustive validation before it can be issued than does a D-U-N-S Number.Is US-centric (there are other tax IDs for other countries).Is not required for all business entities, including sole proprietorships.Does not necessarily reflect a one-to-one relationship between the number and a business (any given business can have many).Can change, which means it is not persistent or consistent over time.

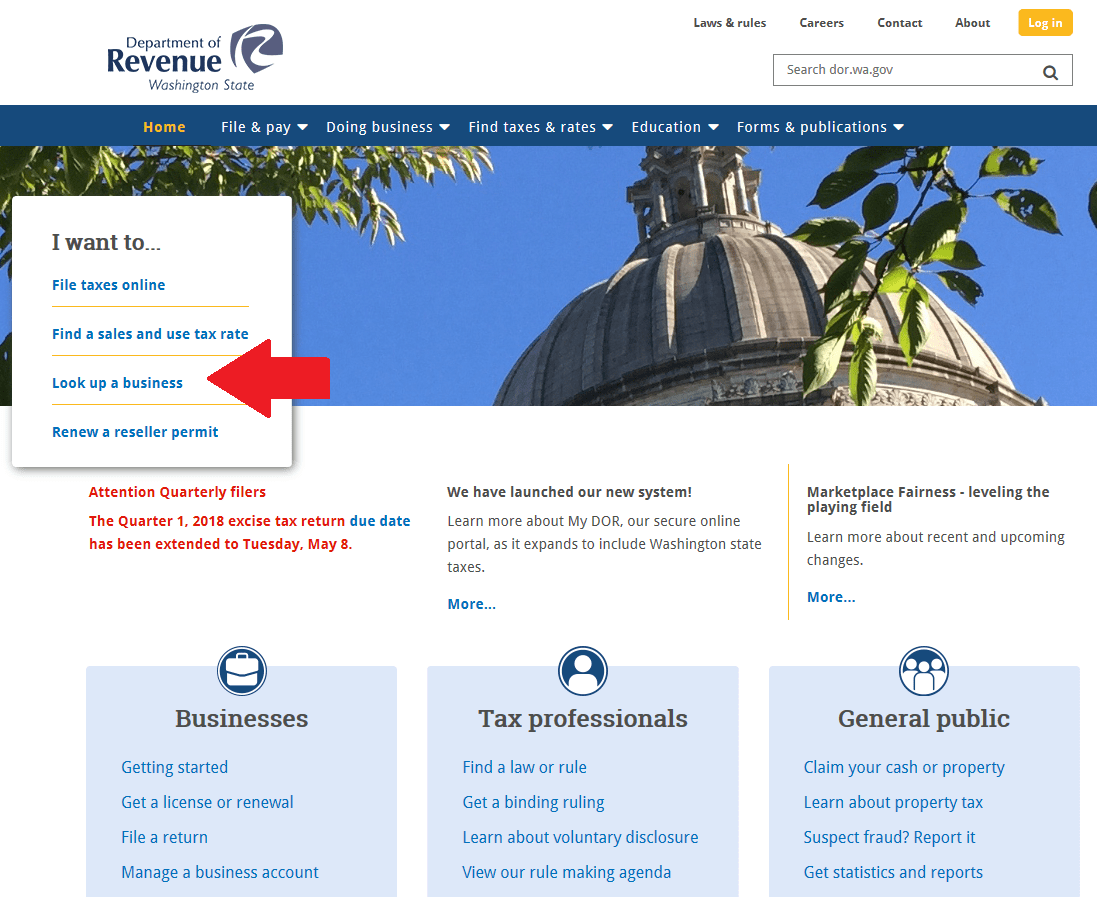

L&I NUMBER VS UBI VERIFICATION

The IRS issues an EIN based on a business-information form, with verification resting primarily on the responsible party’s Social Security Number or existing EIN.

0 kommentar(er)

0 kommentar(er)